Mortgage and How Does It Work

What Is a Mortgage and How Does It Work?

Buying a home is a dream for many Americans, but most people don’t have enough cash to pay for a house outright. That’s where a mortgage comes in. A mortgage is a loan specifically used to buy real estate, allowing buyers to purchase a home and pay for it over time.

How Does a Mortgage Work?

A mortgage works as a secured loan, meaning the property itself acts as collateral. If the borrower fails to make payments, the lender has the right to take back the home through foreclosure. Here’s how the process generally works:

Related Topics (Ads🙂

mortgage loans usa home loans usa

Best mortgage rates mortgage refinancing

- Applying for a Mortgage

- A borrower submits an application to a lender, such as a bank or credit union.

- The lender reviews financial details, including income, credit score, debt, and employment history.

- Loan Approval and Terms

- If approved, the lender offers loan terms, including the interest rate, loan amount, and repayment period (typically 15 or 30 years).

- Making Monthly Payments

- The borrower makes monthly payments that cover:

- Principal (the amount borrowed)

- Interest (the cost of borrowing the money)

- Property taxes and homeowners insurance (often included in the payment)

- The borrower makes monthly payments that cover:

- Paying Off the Mortgage

- Over time, more of the payment goes toward the principal rather than interest.

- Once the loan is fully paid off, the homeowner owns the property free and clear.

Types of Mortgages in the USA

There are several types of mortgages, including:

- Fixed-Rate Mortgage – The interest rate remains the same for the life of the loan.

- Adjustable-Rate Mortgage (ARM) – The interest rate can change periodically.

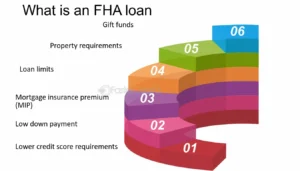

- FHA Loan – Backed by the Federal Housing Administration, ideal for first-time buyers.

- VA Loan – Available to veterans and active-duty military members.

- Jumbo Loan – Used for expensive homes that exceed conventional loan limits.

Key Mortgage Terms to Know

- Down Payment – The initial amount paid upfront (usually 3%–20% of the home’s price).

- APR (Annual Percentage Rate) – The total cost of the loan, including interest and fees.

- Escrow – A third-party account that holds taxes and insurance payments.

- Refinancing – Replacing an existing mortgage with a new one for better terms.

Final Thoughts

A mortgage makes homeownership possible by spreading the cost over many years. Understanding the loan process, types of mortgages, and key terms can help you make informed decisions when buying a home.

Understanding Mortgages: How They Work and What You Need to Know

A mortgage is one of the most common ways people finance the purchase of a home. For many, buying a house outright with cash is not feasible, making a mortgage an essential tool for homeownership. In this article, we’ll break down what a mortgage is, how it works, and what factors to consider before taking one.

What Is a Mortgage?

A mortgage is a loan provided by a lender (such as a bank or credit union) to help a borrower purchase a home. The borrower agrees to repay the loan over time, typically in monthly installments, which include principal and interest. Since a mortgage is a secured loan, the house itself serves as collateral—meaning the lender can seize the property through foreclosure if the borrower fails to make payments.

How Does a Mortgage Work?

Here’s a step-by-step look at how a mortgage works:

1. Loan Application and Approval

Before getting a mortgage, the borrower must apply for one. The lender evaluates the applicant’s:

- Credit score – A higher score often leads to better loan terms.

- Income and employment history – Lenders want assurance that the borrower can repay the loan.

- Debt-to-income ratio (DTI) – The percentage of income used to pay debts.

Once approved, the borrower receives an offer letter detailing the loan terms.

2. Down Payment

Most mortgages require a down payment, an upfront amount paid toward the home’s price. Common down payments range from 3% to 20% of the home’s value. A larger down payment usually means lower monthly payments.

3. Monthly Payments

The borrower repays the loan through monthly payments, which include:

- Principal – The amount borrowed.

- Interest – The cost of borrowing the money.

- Property taxes – Collected by the lender and paid to the government.

- Homeowners insurance – Protects against property damage.

4. Loan Repayment and Ownership

Most mortgages last 15 to 30 years. Over time, the borrower pays down more of the principal. Once the loan is fully paid off, the homeowner owns the property outright.

Types of Mortgages

Several types of mortgages are available, each with unique benefits:

- Fixed-Rate Mortgage – The interest rate remains constant throughout the loan term.

- Adjustable-Rate Mortgage (ARM) – The interest rate fluctuates based on market conditions.

- FHA Loan – A government-backed loan requiring a lower down payment, ideal for first-time buyers.

- VA Loan – Available to military service members with no down payment required.

- Jumbo Loan – For expensive homes that exceed conventional loan limits.

Key Factors to Consider Before Getting a Mortgage

Before taking out a mortgage, consider:

- Interest Rates – Compare fixed vs. adjustable rates.

- Loan Term – Shorter terms (15 years) have higher payments but lower overall interest.

- Total Loan Cost – Calculate the total cost over time, including fees and taxes.

- Affordability – Ensure monthly payments fit within your budget.

Conclusion

A mortgage is a powerful tool that makes homeownership possible, but it’s important to understand its terms and obligations. By choosing the right mortgage type and carefully planning your finances, you can make informed decisions and secure a home that fits your needs.

ytfontnopufypmphvoydmpurhhhtzi